Our transaction specialists have a deep understanding of the industry through numerous transactions and interim assignments. We know the strategic market participants and investment companies that want to grow inorganically in your industry. Nationally and internationally, we are close to potential investors for your company. Only if a strategic added value can be achieved, we achieve a very satisfactory result for you and your company together with you.

Foundry

The steel foundry sector is an important intermediate sector in German industry. Cast steel products are excellently suited as a construction material for vehicle construction as well as mechanical engineering and steel construction due to a variety of properties such as good weldability.

Mechanical Engineering

The mechanical engineering sector, which primarily manufactures machines, components and other capital goods for a wide variety of manufacturing industries, has experienced ups and downs over the past five years

With the global economic upswing, German machinery is once again in demand, but strong international competition and the digital transformation pose challenges for producers

Automotive

The entire automotive industry is in a period of upheaval. Worldwide, automobile production has been declining since 2018. Motor vehicle manufacturers (Original Equipment Manufacturers = OEMs) and their suppliers have to deal with trends such as digitalisation and electromobility, among others.

Plastic injection moulding

With an annual turnover of about € 61.5 billion and 322,000 employees in over 3,037 companies, the plastics processing industry is one of the most important economic sectors in Germany. The predominantly medium-sized sector is characterised by high innovative strength and a diverse product range.

ICT IT System House & Telecommunications

Information technology is the second largest industrial sector in Germany. In the current year, expenditure on information technology, telecommunications and consumer electronics will grow by 3.6 percent compared to 2021 and is expected to reach a volume of 184.9 billion euros.

Manufacture and production of building materials

High infrastructure investments and the boom in residential construction are keeping the construction-related segments of the industry stable even in the coronavirus pandemic. The investment framework for transport infrastructure projects is expected to expand in the coming years

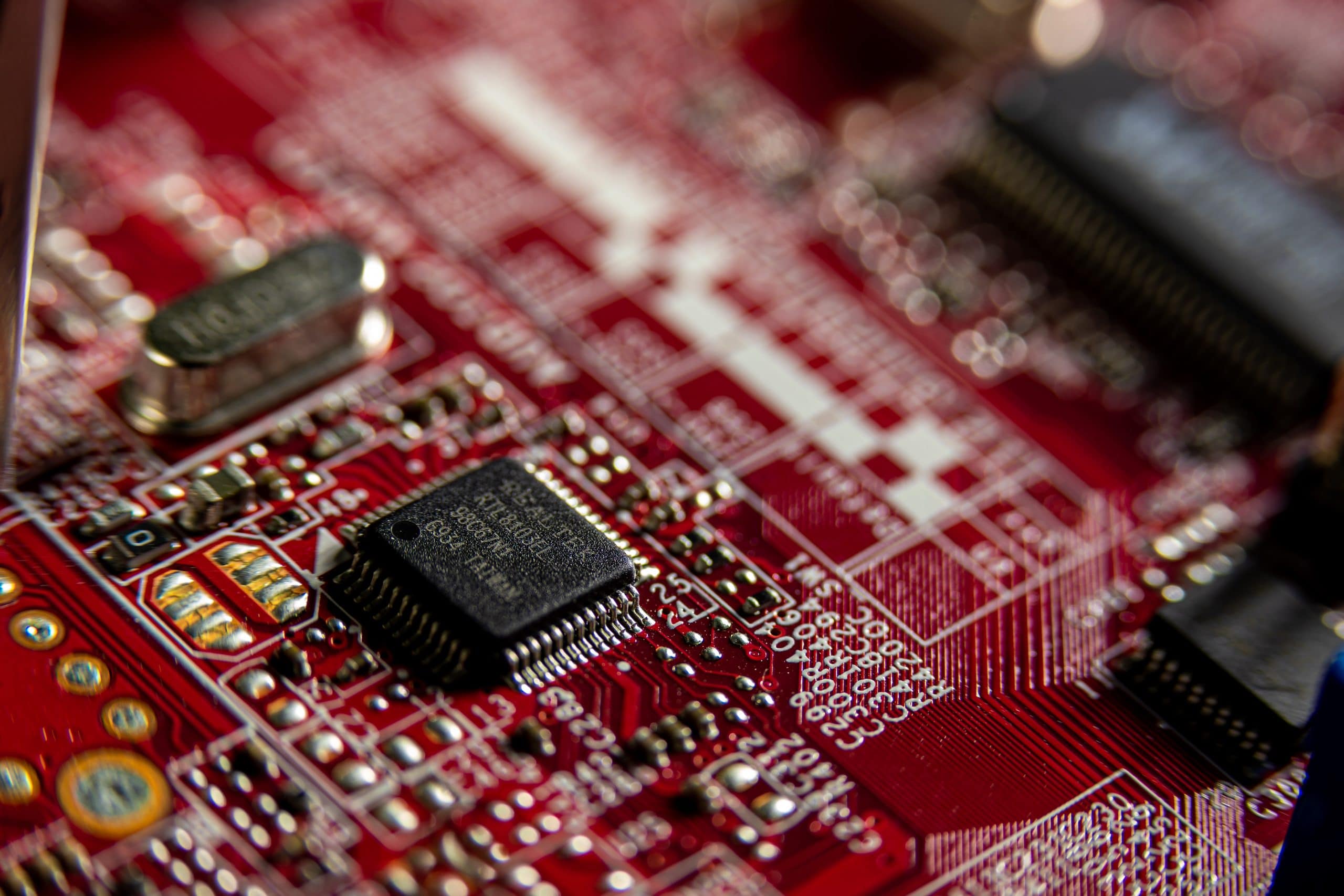

Electrical engineering and electronics

Companies in this sector produce integrated circuits, semiconductors, light-emitting diodes, bare PCBs and other components for electronic applications. Progressive digitalisation is giving the industry new impetus, even if the after-effects of the Corona crisis are currently still being felt

Healthcare

The health care system ensures the health care of the German population. The coronavirus pandemic continues to have a firm grip on the health system, but backlogged surgeries and the advancing vaccination campaign are ensuring rising revenues

Food and luxury foodstuffs

Due to the Corona crisis, demand for convenience products increased significantly in the previous year, but is expected to normalise again this year with the relaxation of infection control measures. Food retailers are also increasing price pressure on industry participants.

Sector Know-how

– What influences does the corona pandemic / war in Ukraine have on transaction activities in your sector?

– What key trends are shaping your sector and influencing investment decisions?

– According to which sector data and KPI do investors assess a potential engagement?

– What external influencing factors affect your sector?

– What life cycle stage is your sector in?

– How high is the market concentration and which potential targets might be of interest after a platform investment?

– What is the cost structure?

– What are the barriers to market entry?

– How are companies in your sector valued?

We deal with the above questions about your sector on a daily basis and know the background to why a strategic market player or an investment company would want to invest in you and your company. Our sector experts talk to you at eye level and can thus work out the strategic fit and added value well.

Completed M&A projects

Further references

Our Specialists

Thorsten Stark

Senior Partner

24/7 Uptime

Frank Jäger

Senior Expert / Partner

24/7 Uptime

David Kremer

Senior Expert / Partner

24/7 Uptime