The automotive industry has long since switched to crisis mode. Numerous automotive suppliers already had to file for bankruptcy in 2020, and the sell-off has only just begun.

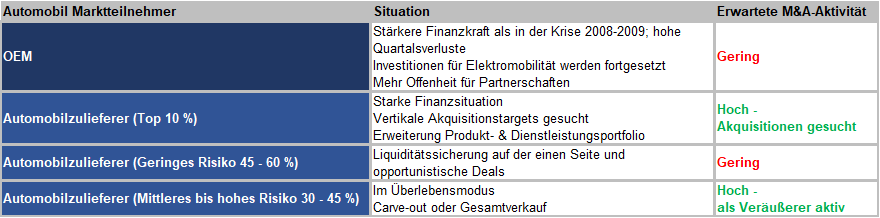

According to a current market assessment, only about 10 percent of suppliers are currently in a position to go on a shopping spree. The Corona crisis is creating opportunities here that can be exploited by the above-mentioned group of investors. Between 45 and 60 percent of suppliers have to choose between strengthening their current liquidity situation and inorganic growth. 30 – 45 percent of the suppliers are in survival mode and are currently not in a position to grow through acquisitions. The considerations are more in the direction of carve-out or total sale.

Thus, a high number of suppliers will keep a low profile and try not to get into liquidity difficulties. Already today, one expects up to 25 large transactions in Europe with a total value of around 12 billion US dollars.

The M engine will therefore continue to run, but under different signs. The consolidation is only just picking up speed and the valuations and multipliers are plummeting. As a result, the bargaining power on the sellers’ side will continue to decline.

Do you have questions or need support on the topics of MA / Private Equity? We can be reached at 02150 7058 210, by email at office@starkpartners.de or on the web at www.starkpartners.de.

Related Posts

November 13, 2025

Distressed Mandate KaTec (Troisdorfer Kanalsanierungstechnik GmbH)

starkpartners manages the exclusive investor process. Interested investors can…

April 30, 2025

Investment Opportunity in a Future-Oriented Practice Consultancy with Software Support

In collaboration with our Senior Advisor Mr. Alexander Kögel, starkpartners has…

January 27, 2025

Team Reinforcement in January

We are pleased to welcome Mr. Leon Röbke as a career starter in orientation at…