Germany’s industrial landscape stands at a turning point. While skilled labor shortages, geopolitical uncertainties, and rising cost pressures present new challenges for companies, robotics and automation open up unforeseen opportunities. They are no longer a vision of the future, but a decisive factor for competitiveness, efficiency, and innovation – especially for mid-sized businesses. In an era where production processes are being rethought and value chains digitally networked, robotics is becoming the engine of a new industrial era. Those who invest in smart automation today lay the foundation for sustainable growth – technologically, organizationally, and strategically.

The geopolitical shifts of recent years, from supply chain disruptions to the shortage of skilled workers, have had a lasting impact on Germany’s industrial landscape. In this environment, robotics is developing into a key technology for Industry 4.0, smart factories, and intelligent production systems that goes far beyond classic automation. It is now considered a prerequisite for maintaining competitive production in Germany, a high-wage country, in the future. The VDMA speaks of a development without which industrial manufacturing would not be conceivable in the long term. This opens a new chapter in industrial transformation for medium-sized companies, which are traditionally characterized by engineering skills, flexibility, and niche expertise.

The robotics and automation industry in Germany is expected to generate total sales of €14.5 billion in 2025 – a 10% decrease compared to the previous year. Automated Solutions are particularly affected, with an expected 15% drop in sales to €7.7 billion. Robotics is expected to generate €3.7 billion (-5%), while industrial image processing will stagnate at €3.1 billion. The main reasons for the current weakness are postponed investment projects as a result of geopolitical tensions and increasing competitive pressure from the Far East. Against this background, the VDMA presented the “Robotics Action Plan for Europe,” which calls for more venture capital for start-ups, a roadmap for competitiveness, and a focus on the scalability of European innovation. The aim is to reduce location disadvantages in international competition, strengthen Europe’s role in the global race for AI, robotics and automation, and drive forward the digitalization of industrial manufacturing.

Despite the current decline in revenue, the market offers great potential for investments in industrial automation, intelligent robotics, and autonomous manufacturing solutions. Funding programs at national and European levels, which co-finance investments in digitalization and automation, create additional incentives. Companies that invest early in robotics and smart automation benefit from productivity increases, cost reductions, and significant efficiency gains – empirical values speak of up to 40%. Especially for mid-sized businesses that want to secure their competitiveness and withstand the increasing pressure from global competitors, this step is strategically indispensable.

The M&A market in the field of robotics and industrial automation has also become significantly more active in recent years. Strategic buyers within the industry are specifically acquiring companies specializing in autonomous vehicles, autonomous mobile robots, integration expertise, and automation systems – such as logistics robotics or product transport within factories. At the same time, companies that already use robotics internally are acquiring corresponding technology specialists or suppliers in order to accelerate their own automation processes and reduce dependencies. These acquisitions often serve not only to expand the portfolio, but also to acquire know-how, software components, AI solutions, or intellectual property. This trend is accompanied by private equity investors and financial investors pursuing platform strategies: they create economies of scale through acquisitions of specialized players, bundle capacities, and strive for increasing margins. Market observers see that companies with a strong software or AI component as well as clear digitalization approaches achieve particularly high valuations in M&A deals. In this context, starkpartners was present at the all about automation trade fair in Düsseldorf this year and took the opportunity to exchange views with expert participants from the industry on the market environment, trends, and its own product and service offerings in the area of M&A.

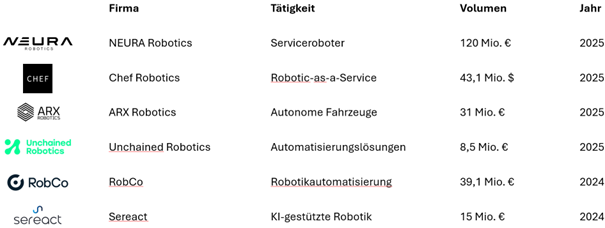

M&a Deals in the Robotics & Automation Sector (Excerpt)

Start-up Funding in Robotics & Automation

The opportunities are great, but so are the challenges. In addition to capital commitment and the integration of new systems into existing structures, the shortage of skilled labor remains a central impediment. Specialized employees are often lacking not only in manufacturing but also in programming, maintenance, and system integration. At the same time, cultural acceptance within the workforce is not always a given. Mid-sized companies are therefore called upon to actively shape the transformation and accompany change processes with clear communication.

How does starkpartners support in this market environment?

Especially in the dynamic environment of robotics and industrial automation, it becomes clear how closely technological innovation and strategic corporate development are intertwined. Many mid-sized companies face the question of how to acquire growth capital, structure succession options, or strategically expand their know-how with a partner.

starkpartners accompanies entrepreneurs in this phase with a clear focus on value enhancement, succession, and sustainable positioning. Our approach combines industry understanding with strategic vision: We identify investors who value technological expertise and entrepreneurial culture equally – and thus create transactions that secure innovation and shape the future.

Whether it’s the transaction of an automation technology specialist, the search for a strategic partner in robotics, or preparation for further growth: starkpartners stands for discreet, entrepreneurial consulting – at eye level, with technological understanding and deep respect for the life’s work of our clients.

Related Posts

December 2, 2025

Commercial Property – Draschwitz, Ziegeleistraße 3

Discover the advantages of these properties for your real estate investment for…

November 28, 2025

starkpartners continues to grow

starkpartners continues to grow: Eslami-Zadeh and Yash Pisat join the team

November 26, 2025

Maxburg Capital Partners GmbH acquires a stake in AAC Praxisberatung AG

As part of a structured and competitive investor process, Maxburg Capital…